As an Amazon seller you may be chasing revenues, but are you sure you’re earning a decent profit?

Because of many hidden expenses and fees, many Amazon sellers have difficulty accurately calculating their true profits. Without that knowledge, it’s impossible to make informed decisions and plan ahead.

This is where the Amazon Profit and Loss (P&L) statement comes in.

The P&L statement is a valuable tool that provides sellers with a clear understanding of their business’s financial performance. It includes data on revenue, expenses, and profit – everything you need to calculate your real earnings.

In this guide, we will take a closer look at…

- Amazon’s P&L statement,

- where to find it,

- and how to benefit from its data.

What Is Amazon’s Profit and Loss Statement?

Amazon’s profit and loss statement is a financial report that summarizes your business’s financial performance over a specified period.

It shows:

- the revenue you earned,

- the costs you incurred,

- and the resulting profit or loss.

The report provides information vital for Amazon sellers, including the revenue generated, the cost of goods sold (COGS), shipping costs, and Amazon fees. It also shows your net income, which is what you have earned after all expenses are deducted from your revenue.

Analyzing your Amazon profit and loss statement can give you insights into your business’s financial health.

For example, you can identify which products are generating the most revenue and which ones are costing you the most money. You can also determine which expenses are essential and which ones can be reduced to increase your profits.

What Is Amazon P&L Crucial for Businesses?

Imagine not having a clear picture of your business’s cash flow. You could be left in the dark, unsure whether you are netting profits or losses on each sale and unable to make informed decisions and plan ahead.

With Amazon profit and loss statement, you can get an accurate understanding of your business performance and profitability by tracking expenses against sales.

This helps you understand the impact of your pricing strategy, marketing efforts, and inventory management decisions. You are able to identify which products are profitable and which need to be reevaluated.

You can also use Amazon P&L statements to monitor changes in your business performance over time, such as the impact of increasing or decreasing marketing budgets, or how well seasonal promotions have performed.

This data can help you make informed decisions on pricing strategies, inventory levels, and product mix in order to maximize profitability.

Where Can You Find Your Amazon Profit and Loss Statement?

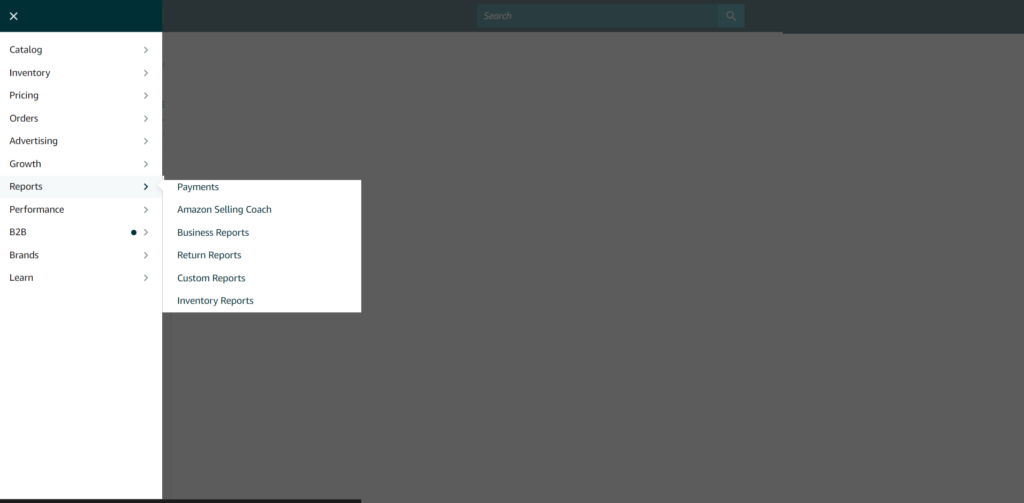

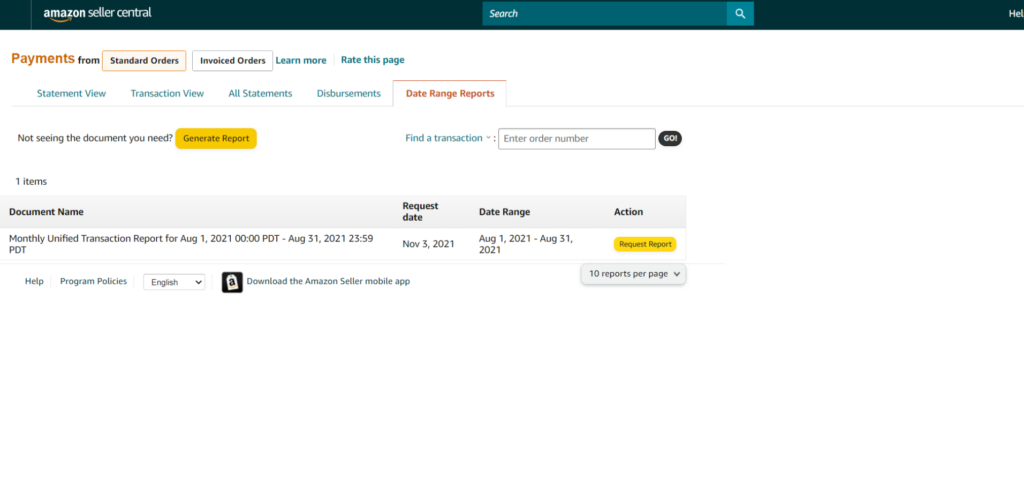

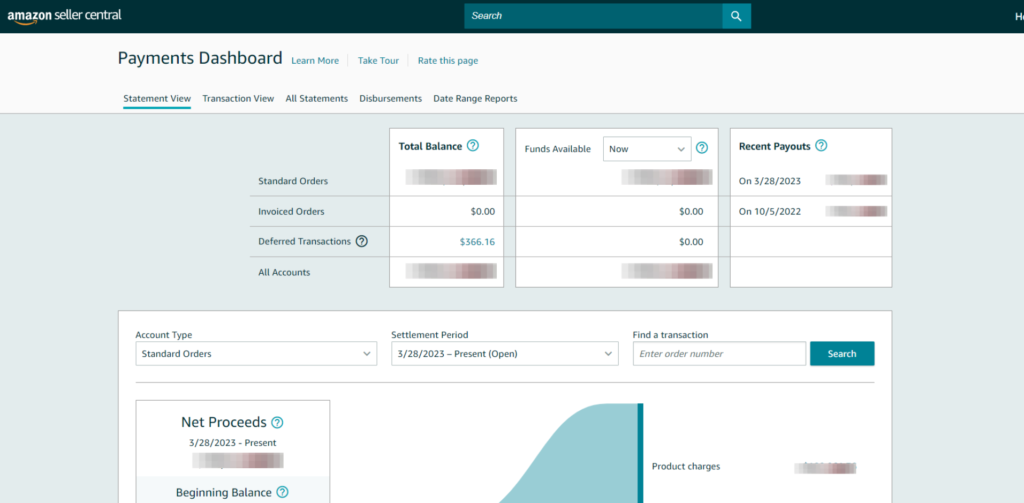

To access your Amazon seller profit and loss statement, you’ll need to log in to your Amazon Seller Central account and further follow these steps.

- Click on the ‘Reports’ tab in the top menu.

- Select ‘Payments’ from the dropdown menu.

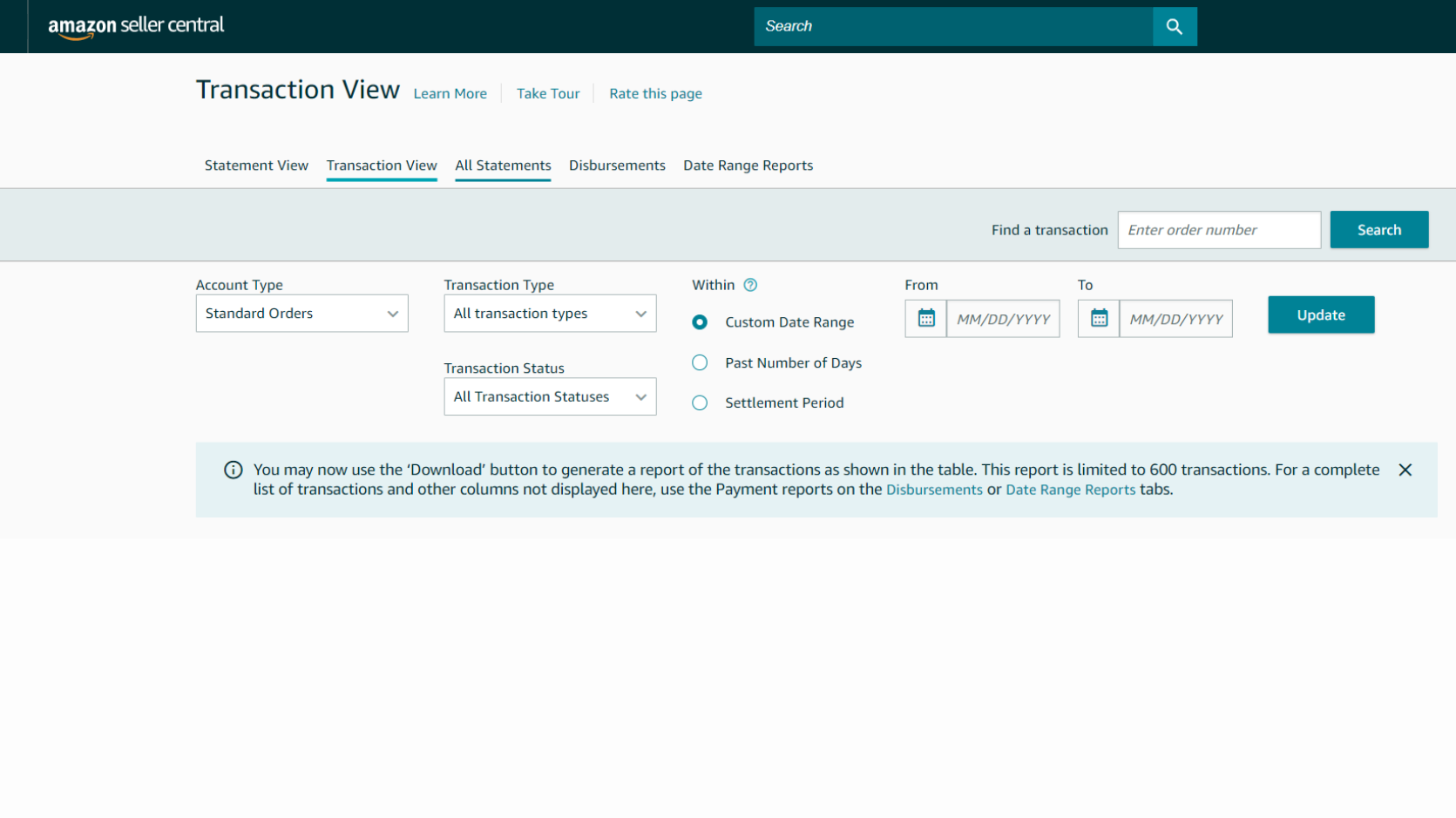

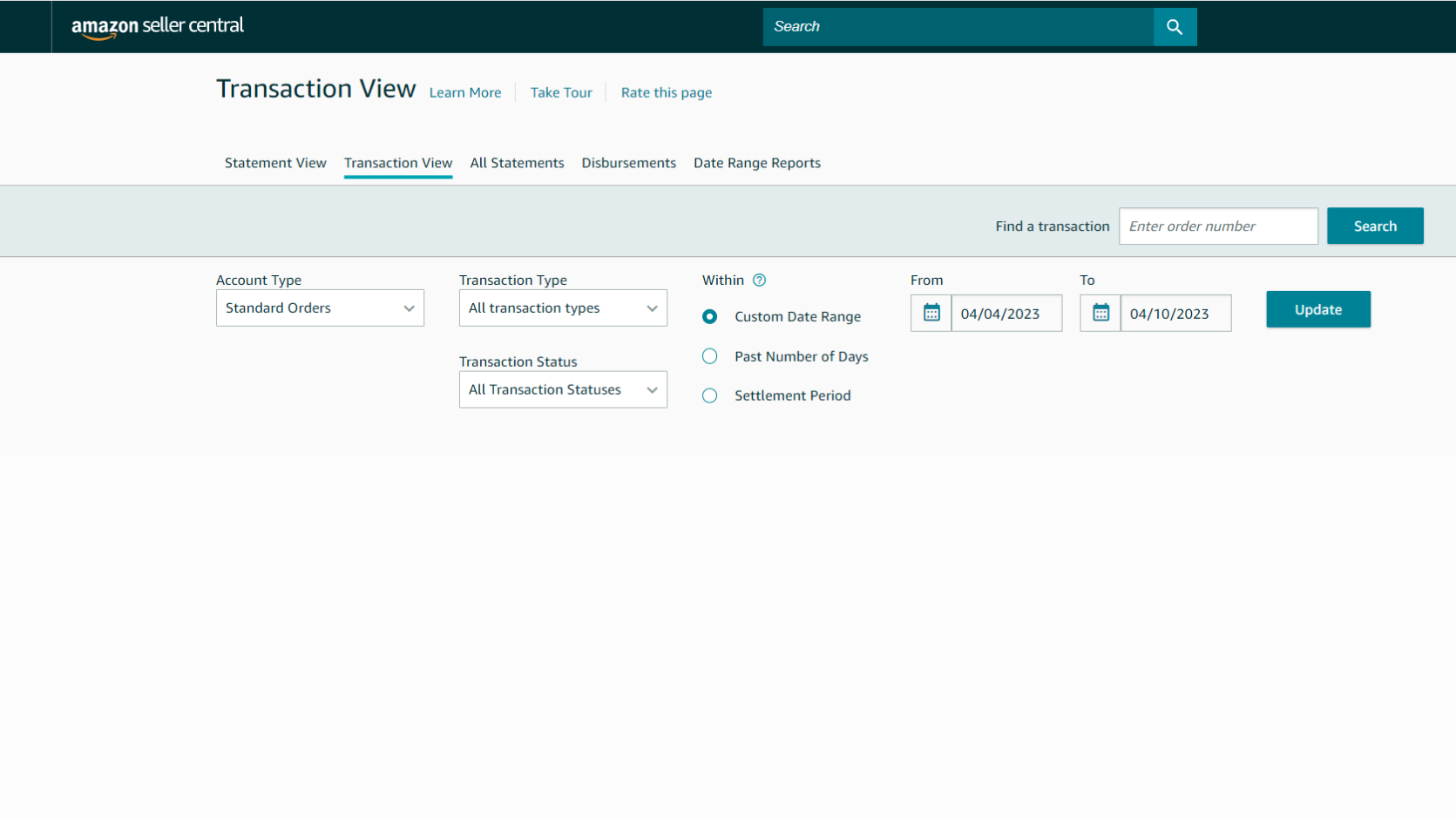

- Click on the ‘Transaction View’ report.

- Set the date range for the report you want to view.

- Click ‘Generate Report’ to generate the report.

- Once the report is generated, click on the ‘Download’ button to download the report in a CSV format.

In your Amazon profit and loss statement, you’ll be able to see a breakdown of your revenue, expenses, and net income for the specified time period. You’ll also see a detailed breakdown of fees charged by Amazon, including referral fees, FBA fees, and shipping fees.

Why Isn’t Seller Central’s Report Enough to See the Big Picture of Your Business?

While Seller Central’s report provides valuable information about your business’s financial performance on Amazon, it may not be enough to give you an accurate picture of your profits.

You can think of Seller Central as a source of the raw information, but it’s up to you to make sense of those numbers and create a comprehensive profit and loss statement.

Let’s break down the gaps of what Seller Central’s report does not provide and how you can fill them with specialized sales analytics software.

Some Expenses Are Not Included

One crucial limitation of relying solely on Seller central profit and loss statements is that it does not include all of the expenses that sellers incur in running their businesses. While Amazon’s centralized data hub provides valuable insights into revenue and fees, it doesn’t include expenses like the Cost of Goods Sold, which is a crucial expense for many sellers.

No Detailed Analysis on Performance of Individual Products

Another important limitation of Seller Central’s profit and loss statements is that it does not offer detailed insights into individual products or product categories. This lack of specificity can make it challenging for sellers to determine which products generate the most sales and profits, and which ones may need improvement.

This can make it harder for sellers to make informed decisions regarding their product mix and pricing strategies. Consequently, it’s crucial for sellers to have access to a tool that offers more granular insights into individual product performance.

No Detailed Suggestions on How to Improve Amazon Profit and Loss

Lastly, Seller Central does not provide detailed suggestions on how sellers can improve their profitability. While Seller Central may provide raw data, many sellers may not have advanced technical or analytical skills to interpret the information correctly.

This can result in valuable insights being missed, and sellers may end up continuing to pursue blind strategies instead of making wise business decisions backed by robust data analysis.

How to Leverage Amazon P&L Data and Get the Most Out of It

Amazon Seller Central lacks some crucial details needed to build the complete picture of the sales performance. However, manually calculating additional metrics and including them in the Profit and Loss data can be time-consuming and error-prone.

To address this challenge, sellers can automate this process with a professional software like SellerMobile that automatically extracts data from Seller Central, leverages it and provides detailed suggestions to sellers.

In this section, we will discuss both manual and automated methods of leveraging Amazon P&L data.

Accurate Amazon P&L Manually

Manual calculation of Amazon P&L data involves extracting data from Seller Central and calculating various metrics like net sales revenue, COGSS (Cost of Goods Sold), gross profit, overhead costs, operating profit, and net income. Let’s discuss each step in detail.

Step 1: Add Net Sales Revenue to Your Amazon Profit and Loss Statement

Net sales revenue is the total revenue generated by a seller after deducting returns, discounts, and taxes. To extract this information from Seller Central, follow these steps:

- Log in to your Seller Central account.

- Go to the ‘Reports’ section and select ‘Payments.’

- Select the time period for which you want to extract the data.

- Click on ‘Generate Report.’

- Once the report is generated, download the CSV file.

- Open the file and find the column ‘Net Sales.’

To calculate net sales revenue, add up the values in the ‘Net Sales’ column for the selected time period. This is your total net sales revenue. Net sales revenue is a crucial metric as it gives you an idea of your top-line revenue and helps you understand the demand for your products.

Step 2: Calculate COGS (Cost of Goods Sold)

Cost of Goods Sold (COGS) is the total cost incurred by a seller to produce or acquire the products sold. COGS includes the cost of raw materials, labor, shipping, packaging, and any other direct costs associated with the production or acquisition of the products. To calculate COGS, use the following formula:

Beginning inventory is the value of inventory at the beginning of the selected time period.

Purchases are the total cost of inventory purchased during the time period.

Ending inventory is the value of inventory at the end of the time period.

COGS is a crucial metric as it helps you understand the profitability of your products and make informed pricing decisions.

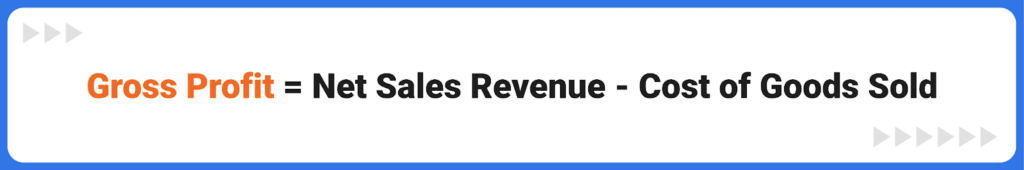

Step 3: Calculate Gross Profit

Gross profit is the profit generated by a seller after deducting the Cost of Goods Sold from the net sales revenue. To calculate gross profit, use the following formula:

Step 4: Calculate Overhead Costs

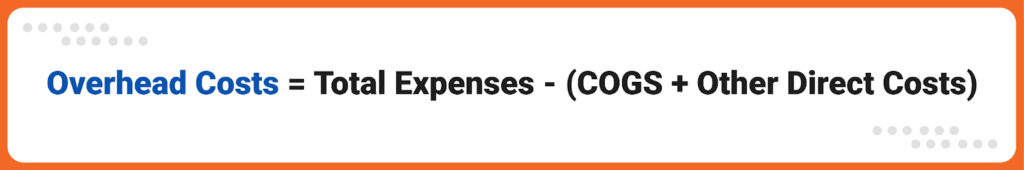

Overhead costs are the indirect costs associated with running a business, such as rent, utilities, salaries, and marketing expenses. To calculate overhead costs, use the following formula:

Total expenses include all the expenses incurred by a seller during the selected time period, including direct and indirect costs.

Other direct costs include the cost of shipping, packaging, and any other direct costs associated with the sale of the products.

Step 5: Calculate Operating Profit

Operating profit is the profit a company makes from its core business operations, excluding interest and taxes. To calculate the operating profit, subtract overhead costs from the gross profit.

The formula for calculating operating profit is:

Overhead costs include expenses such as rent, salaries, utilities, and other general and administrative expenses. It is important to calculate the operating profit as it provides insights into how well a company’s core operations are performing, which is a key indicator of its overall financial health.

By monitoring the operating profit, Amazon sellers can identify areas where they can reduce costs, improve efficiency, and optimize their business operations. This can help increase profitability and drive long-term growth.

Final Step: Calculate Your Net Income

To calculate net income, we start with the operating profit and then subtract any taxes and interest expenses. Taxes include any federal, state, or local taxes paid on the profits, while interest expenses refer to any interest paid on loans or other debts.

The formula for calculating net income is as follows:

Calculating taxes and interest expenses can be more complicated than the previous steps, as these expenses can vary greatly depending on a number of factors such as the seller’s location, the type of business entity, and the amount of debt owed.

Taxes, for example, can be calculated by looking at the seller’s tax rate and the amount of taxable income earned. Interest expenses, on the other hand, can be calculated by looking at the seller’s interest rate and the amount of debt owed.

Accurate Amazon Profit and Loss Statement With SellerMobile

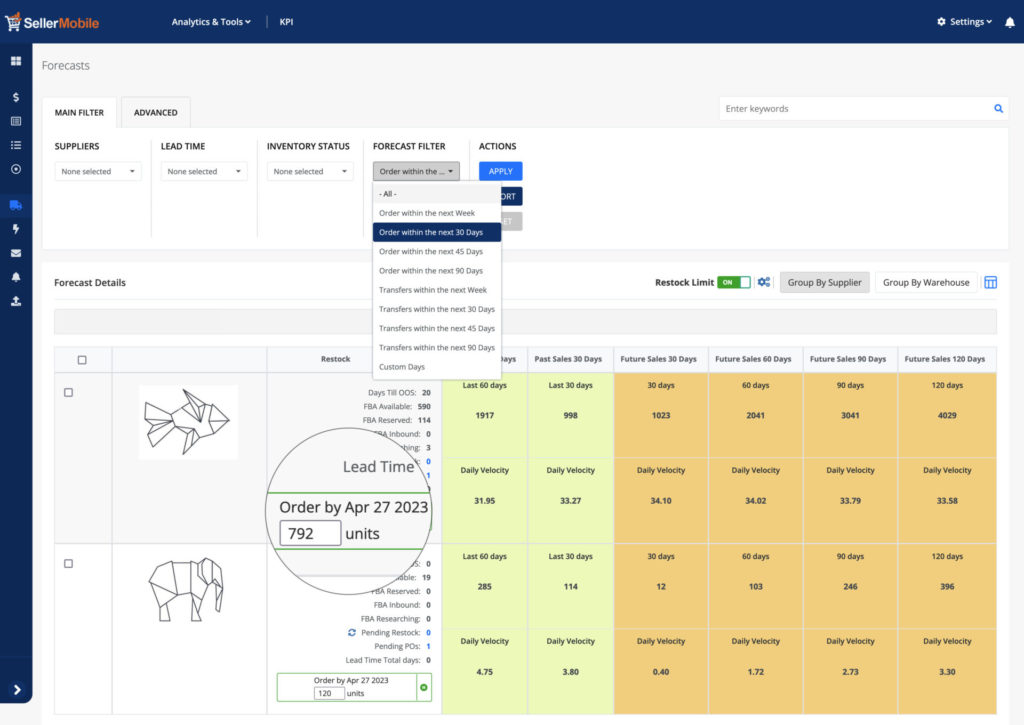

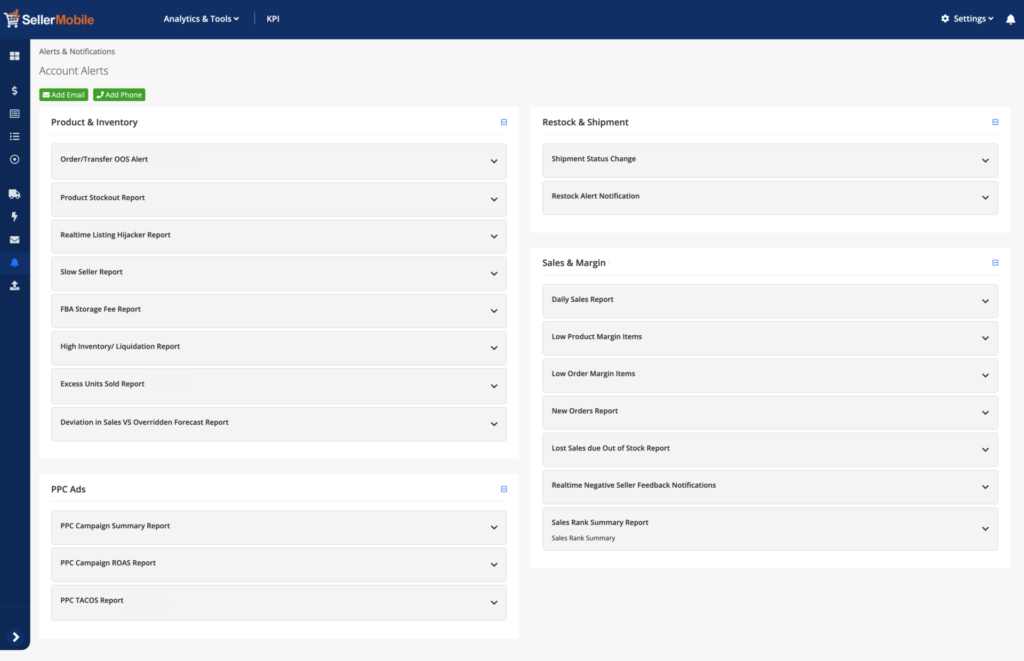

SellerMobile is an all-in-one platform that automatically retrieves data from Amazon Seller Central. With its Product Performance toolbox, SellerMobile enables sellers to easily generate an accurate Amazon FBA Profit and Loss statement that not only provides you with valuable metrics, it also analyzes them to gain valuable business insights.

One of the unique value propositions of SellerMobile is its ability to provide sellers with personalized recommendations based on their specific data. The tool uses advanced analytics and machine learning algorithms to identify trends and patterns in the data, and offers sellers practical insights to help enhance their performance.

The Product Performance toolbox allows sellers to see a detailed breakdown of their revenue and expenses, giving them an accurate view of their overall profitability. Sellers can easily track their profit margins, revenue, and expenses over time, and identify any areas where they may need to make adjustments to improve their profitability.

One of the key features in the product performance toolbox is the Excess Inventory Tool. This tool identifies slow-moving inventory and provides a detailed analysis of the inventory levels, age, and potential risk to the seller’s business. With this information, sellers can take immediate action to reduce their inventory holding costs and improve their overall profitability.

Overall, SellerMobile’s product performance toolbox provides sellers with the tools they need to generate an accurate Profit and Loss statement, optimize their inventory levels, improve their product quality, and increase their profitability.

The Bottom Line

An Amazon Profit and Loss statement is your partner in understanding your business’s performance and profitability. It helps you create smarter pricing strategies, and manage inventory levels and the product mix to maximize profits.

As a starting business, which sells only a couple of products, all you have to do is check Seller Central’s report. At the initial stages, this report can suffice to make sense of the raw numbers.

However, if you are scaling your business and have a variety of products in the market, specialized sales analytics software like SellerMobile is a must to create comprehensive reports that provide an accurate picture of your profits and losses.