There’s a catch to everything.

Especially if it’s about business.

Especially if it’s about selling on the global e-commerce giant.

Amazon is a good friend of online sellers, helping them promote and sell their products faster than they could if starting from scratch.

(If you have ever tried to promote a product online from ground zero, you know what we mean.)

Today, Amazon is a major marketplace with around 9.7 million sellers worldwide, over 150,000 of which have more than $100,000 in annual sales.

And it’s no wonder Amazon takes approximately 50% of sellers’ revenues (more detailed breakdown and explanations of unique cases below) for all the platform’s perks — detailed analytics, customer service support, fulfillment services, and more.

Should this number fear you? A resounding NO!

It should just hint you to:

- Dig deep into the scheme of Amazon seller fees

- Be well-informed about your financial obligations

- Avoid making costly mistakes

Luckily, this blog article teaches you every nook and cranny of Amazon seller fees so you can know what to expect in 2023.

Let’s dive right in!

When Do I Have to Pay Amazon Seller Fees?

Amazon is kind, providing two options regarding when to pay fees.

You can either pay a lump sum each month and free your thoughts from worries about Amazon seller fees for a while, or you can pay after you make sales to ensure you only pay what you owe.

Here are the two seller plans Amazon currently offers to you.

Option 1: Individual Selling Plan ($0.99/item Sold)

An individual selling plan is a starter for Amazon selling. It’s more recommended to those selling less than 40 units a month or those just testing the waters and wanting to avoid committing themselves to a monthly subscription fee.

With this plan, you do not have a fixed monthly payment to Amazon. Each time you sell an item, you pay $0.99 (+ other applicable Amazon seller fees).

This plan offers very basic functionality. You can only add new products to the Amazon catalog and use the Fulfillment by Amazon service.

Option 2: Professional Selling Plan ($39.99/month)

Here is a more advanced selling plan, which charges you a monthly fixed fee of $39.99 (+ other applicable selling fees) and frees you from per item fee after every purchase.

A professional plan is a good option for those who sell more than 40 items and those who want access to the advanced selling functionalities that Amazon offers. In other words, it’s for established sellers serious about growing their business on the platform.

With this plan, you can enjoy Amazon’s services, such as applying for sales in additional categories, creating listings in bulk, using API integrations, and more!

The Main Seller Fees on Amazon

We know you have many questions now:

- What are Amazon seller fees?

- How much are Amazon seller fees?

- How to calculate Amazon seller fees?

- What happens if you don’t pay seller fees on Amazon?

Before you get into the long list of Amazon seller fees, consider below we listed the most common ones that Amazon sellers usually pay.

The Amazon seller fees you should pay depend on your account type, niche, and other factors. So, along with familiarizing yourself with these fees, you should also carefully read the seller agreement to learn which Amazon seller fees apply to your business.

Note!

- Not every fee listed below is applicable to your business.

- You may have to pay Amazon professional seller fees not listed below if special terms apply to your products or transactions.

Let’s move to the list of Amazon seller fees explained.

1. Referral Fees (8-45%)

Amazon referral fee is the % of your sold item’s price you pay to Amazon. This fee varies based on what you sell (the category your item falls into) and your selling price (to calculate the fee %).

The category of your product that appears on the Amazon retail site is not the same as the fee category used to calculate the referral fee. So, you must check Amazon’s Category Referral Fees for a more accurate calculation.

There are two things you must know about referral fees.

- Some categories have minimum referral fees, which means if the % of the sold item’s price appears to be less than the minimum amount set by Amazon for that particular category, you must pay the minimum amount instead.

- For all the products sold under Amazon’s “Media” category, such as books, DVDs, music, video, etc., there is a closing fee of $1.80 per sold item. This means you will pay the regular referral fee + the closing fee if you sell products from this category.

2. Amazon FBA Seller Fees (10-15% for Standard-Sized Packages)

Regarding fulfillment fees, some key factors impact the amount you pay.

Amazon Handles Fulfillment

If you choose FBA service, which means Amazon does the fulfillment of your orders, you will pay for picking and packing your orders, shipping and handling, customer service, and product returns.

How much you pay for each item depends on your product’s dimensions and weight. For example, small standard items (15″ x 12″ x 0.75″ with 4 oz or less shipping weight) cost you $3.22, while large oversize products (108″ (longest side) with 150 lb or less shipping weight) round up to $89.98 + $0.83/lb above first 90 lbs per item.

See the full table of categories here.

So, you must correctly calculate your item dimensions and shipping weight to avoid paying extra for Amazon’s fulfillment.

Seller Handles Fulfillment

If orders are fulfilled on the seller’s side, Amazon will charge shipping rates based on the product category and the customer’s selected shipping service, which varies based on which seller plan you have.

Professional plan users can set their own shipping rates besides the “Media” category products.

Individual plan users have to pay shipping rates set by Amazon.

3. Amazon FBM Seller Fees (Based on Shipping Rates)

FBM stands for Fulfillment by Merchant, where the seller takes responsibility for the entire shipping process, including picking, packing, and shipping the items. For a moment, you may think Amazon will free you from Amazon professional seller fees in this case, recognizing all the work you put in. Unfortunately, it’s not true. Amazon will charge you less than FBA fees but still charge you for all your sold items.

Things here work similarly to fulfillment fees – professional plan users set their shipping credits, while individual plan users have to pay rates set by Amazon.

In the case of the latter, it’s crucial to carefully track the shipping credits because even if the shipping credit is less than the actual shipping cost, Amazon will still charge you the credit amount.

So, you may need to reprice certain items from your catalog to ensure you cover the shipping costs.

4. Closing Fees (Fixed and Variable)

We have briefly discussed closing fees when talking about referral fees. Now let’s spread more light on the topic.

Closing fees can be viewed as additional referral fees that Amazon charges for products from the “Media” category. There is no exact reason behind it, but one thing is certain – don’t have high-profit expectations if you plan to enter Amazon with media products that are less than $10.

That’s because the fixed closing fee you pay per sold item is $1.80, which adds to your regular referral fees and other Amazon seller fees if applicable. So, calculate the closing fees when setting your prices to ensure profit.

Besides fixed closing fees, there are variable closing fees, which you should not consider the same.

A variable closing fee is charged by Amazon when you submit an offer to purchase and sell items on the platform. Depending on the item’s conditions for which you make the offer, the variable closing fee can range from 0.99-2.50%.

Amazon may reject your offer if you do not pay the variable closing fee. Moreover, this may lead to extra charges on your other sale or purchase.

So, once receiving a chargeback for the variable closing fee, pay it as soon as possible to continue using Amazon’s services.

Closing fees are not common for all categories, but it’s still important to understand how they work and calculate them correctly.

5. Principal Fee (2.9%)

Amazon separates the money you receive from customers for a certain item into main categories.

- Sales tax is the VAT that’s usually included in your product price.

- The principal is the difference between your selling price and VAT.

So, for example, if your customer paid $40 to purchase an item for you, and the VAT was $2, then the principal will equal $38.

The 2.9% of the separately presented VAT in your transactions is charged from you by Amazon and recorded as sales tax collection fees. So, 2.9% of your $2, in this case, is $0.058, which you have to pay Amazon.

Why is that crucial to know?

Because you need to set reasonable pricing when selling products on Amazon, considering only some part of the money paid to you by your customer will be yours. The bulk part of the price, also called the principal, will be transferred to you (don’t forget referral fees from this amount), but the 2.9% of the remaining sales tax will be deducted from the amount you receive.

So, remember to include that in your pricing to ensure you cover all the Amazon FBA seller fees and still get a good profit.

6. Returns Processing Fee (Depending on Several Factors)

Broadly speaking, you pay the return’s processing fee only when the return is approved because of the factors that lay in your responsibility.

For example, when you ship the wrong item to a customer or it arrives damaged due to poor packaging, Amazon will charge you a return processing fee. However, here we highly encourage you to explore the return policy of Amazon in detail and examine your individual case closely. The fee you will have to pay in such cases varies depending on many factors, which will be determined by the Amazon support team.

In contrast, if the item was returned to Amazon because of the customer’s fault or the marketplace itself, then no return processing fee will be charged.

This can refer to cases when the customer returns an item because they’ve ordered the wrong size or color or found the same item at a lower price somewhere else.

7. Seller Fulfilled Prime Membership Fee (Currently, Enrollment Is on Hold)

You can have a Premium badge as a seller that allows you to grow your business by having unique access to the most loyal and premium customers of Amazon. Particularly, if you join the Seller Fulfilled Prime program as a permanent member, you can have a special transportation solution provided by Amazon, which allows you to commit to two-day delivery at no additional cost for Prime customers.

This membership lets you directly ship items from your warehouse to Prime customers without intermediary services like FBA. That’s a good chance to position your Amazon account in the marketplace and make a difference.

However, you should prove your excellence in customer service and delivery to Amazon before you can join the Seller Fulfilled Prime program.

You should show high performance in metrics like timely deliveries (99% of orders should be shipped on time), few order cancellations (less than 0.5%), support weekend delivery and pick up, and other criteria.

Currently, you can only join the wishlist of sellers who want to become a Seller Fulfilled Prime member. Once the enrollment reopens, we can be more sure about the membership rates you have to pay.

Miscellaneous Amazon Selling Fees

With a wide variety of seller programs and policies, you may be charged a few more Amazon seller fees. Below, we go into more detail about miscellaneous Amazon FBA seller fees, explaining each case.

1. Fees for Shipping Big and Heavy Items (Adding at Least 0.25 lbs to Your Item’s Weight)

As discussed above, how much Amazon will charge per sold/delivered item also depends on the dimensions and size of the item. The logic is very simple: the bigger and heavier an item, the more expensive it is to ship.

There is a crucial rule you should know. Amazon always adds at least 0.25 lbs of packaging weight to your item. This means if your item weighs around 0.75 lbs, you should not estimate its fee based on the actual weight, but you should also account for the additional 0.25 lbs to be safe and prevent surprises later on.

So, with an item that weighs 0.75 lbs, you will have to pay for around 1 lbs of shipment cost.

This added weight grows depending on how big or heavy your item is. Amazon can also add 1 lbs or more if your item falls into the oversized category.

What does this hint to you? If there is a chance to have more compact packaging without compromising the delivery quality, it might be a good idea to consider such an option. Larger packages that add aesthetic value or more protection can be charged higher Amazon FBA seller fees, so you should think twice before including such materials.

2. Advertising and PPC Ads (Around 20%)

There are over 7,500 products sold per minute on Amazon. The competition is fierce in almost any category. That’s why we list Amazon advertising and PPC budget in the Amazon professional seller fees we thought you should consider.

Some estimations say around 20% of your monthly revenue should be allocated to advertising to gain a solid market presence. The exact numbers depend on the product category and competition, so you should be ready to spend more if your niche is too crowded or sit back and relax if there is little competition in your area.

Here are the main ways Amazon suggests you promote your products on the platform.

- Sponsored Products: This type of ad promotes individual product listings on Amazon. Do you have a competitive product that needs more visibility to gain traction? This type of ad can help you get more eyes on it quickly.

- Sponsored Brands: If you want to promote your overall brand instead of specific products, this type of ad can be very effective. This method promotes your brand logo, a custom headline, and multiple products from your catalog. The advantage of sponsored brands ad is that they display your ad on the relevant shopping results, helping you target those who are already looking for products similar to yours.

- Sponsored Display: That’s a self-service display advertising tool with which you engage shoppers across their purchase journey, not only on Amazon but across the web. For example, with this service, you can run programmatic display ads – a very effective form of digital marketing.

- Stores: Lastly, if you need an immersive place to showcase your products in a multipage and interactive storefront, you can do that with stores promotion. In this way, your ad will be displayed like an e-commerce website.

3. High-Volume Listing Fee ($0.005 per Eligible ASIN)

If you have more than 100,000 products listed on Amazon, and you use Amazon’s FBA storage space to store them, you will be subject to an additional fee imposed on sellers considered high-volume dealers.

Sellers who occupy space with high-volume listings pay $0.005 per eligible ASIN, which is charged by Amazon at the same time as storage fees.

First, the marketplace will try to deduct high-volume listing fees from your account balance. In case it’s not enough or the balance is empty, they will charge it to your credit card, which you should have linked to Amazon.

If your items are priced correctly, accounting for storage fees and other costs, you should not bother too much about this additional fee. With accurate planning, your profits should remain healthy even with high-volume listing fees.

However, in case you plan to scale without considering the extra costs associated with the high-volume listing, you might end up with red numbers.

4. Gift Wrap Price (Depends on Who Does the Wrapping)

If your customers order a gift wrap service from you and they pay for it, you will have to pay a percentage of that fee to Amazon too. Yes, every nice thing comes with a price, and this is one of the Amazon seller fees you should consider if you want to add some festive mood for your buyers.

When you have and don’t have to pay this commission to Amazon depends on who wraps the gift – you or Amazon.

If Amazon does the wrapping, it will add beautiful packaging to the purchase for you, then charge a gift wrapping fee from your customer and immediately take it away from your received payment.

In other words, customers will pay a single price for their purchase, including gift wrapping, from which Amazon will take its share for its provided service.

Otherwise, if you handle the wrapping, you will share a portion of your gift-wrapping cost with Amazon as a gift-wrap commission. You’ll see that number displayed in your transaction data, along with other Amazon seller fees deducted from your received payments.

This gift wrap commission takes a different percentage from your profits depending on the type of product you sell and the customer’s location.

8. Marketplace Facilitator Tax (Depends on the Amazon’s Agreement with the State)

To explain the Marketplace Facilitator Tax or Facilitator Shipping Tax Chargeback to you, we need to start from the beginning.

If your business has a nexus in any US state, you must collect sales tax in those states. A nexus is a minimum presence in a taxing jurisdiction that gives rise to a tax collection duty. In more simple words, if you have a business in any US state that somehow collects or benefits from it, you are obliged to collect sales tax for those states. And since Amazon stores your inventory all over the USA, you most probably have a nexus in some states.

Okay. Now, what’s the Marketplace Facilitator Tax, and why it’s important to you?

Amazon signed contracts with certain US states (aiming to expand the list), according to which Amazon will collect and remit your sales tax on your behalf. So, whenever you sell an item and are liable for collecting sales tax, Amazon will collect the due taxes from your customer and then remit them to the corresponding states.

In other words, the process of paying taxes is automated by Amazon for you. There is no extra cost for such a service; you see the deducted sum in the corresponding field of your transaction data.

By introducing the concept of Marketplace Facilitator Tax, parties aim not to allow sellers to avoid paying taxes for their sales and staying in a so-called “grey zone” where they neither pay taxes nor remit them to the corresponding states.

If Amazon does not have a proper agreement with your state, you will have to pay the sales tax yourself.

Is There a Way to Avoid Amazon Professional Seller Fees?

There is no such thing as a free lunch, and it’s fair, right?

By signing up to Amazon, you instantly enjoy the benefits of appearing in a renowned marketplace with over 300 million active buyers, which is an amazing opportunity for any seller.

All the hard work of managing the logistics, getting the customers to your shop, and finding creative ways to market your products is already done for you. So, you need to pay Amazon seller fees in exchange for these incredible services.

But no one said you can’t deal with it wisely.

We can’t tell you how to avoid Amazon seller fees, but we can hint at ways to minimize them.

Make Your Inventory Run Quickly with SellerMobile

The least favorable situation for any Amazon seller is when they have stale inventory in their stock. You still need to take care of it (pay storage and maintenance fees), and you don’t get the money back for such items.

That’s why you must turn your inventory as quickly and efficiently as possible. With a quick turnover, you will save on storage and other Amazon seller fees associated with stocking. Moreover, with increased sales, you make more money, and the amount you give to Amazon becomes less significant.

Okay, what’s the magic tool to reach this goal?

Specialized software for Amazon’s inventory management can simplify and automate your sales process.

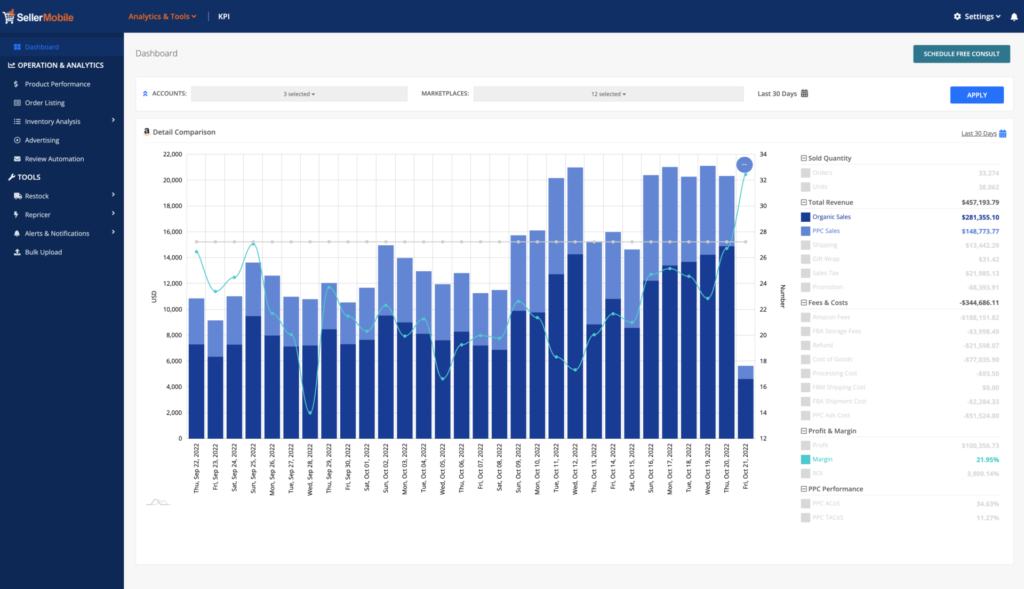

SellerMobile – a professional Amazon automation and inventory management tool – is a great choice here. You integrate it with your Amazon Seller Central account, after which the tool takes over all the tedious manual work and processes orders, analyzes stock levels, creates repricing strategies, and even sends customer emails.

Whenever you log in to SellerMobile, you see the real-time update on your inventory. What’s moving slowly? What stays popular? SellerMobile shows you that and helps to plan your next steps on the go.

Even if you miss checking your inventory report on SellerMobile when certain items are running low, the tool sends you a notification to restock fast. You get a friendly note telling you which items to reorder, when and in which quantities, so you never lose profits because of out-of-stock.

Additionally, SellerMobile forecasts the demand based on your historical sales on the Amazon marketplace and considers the seasonality of certain items. In this way, you find out which items are going to be in demand soon and plan your stock way ahead of the sales season. Whenever there is a difference between your forecasted and actual sales, deviation alerts let you know about it in advance.

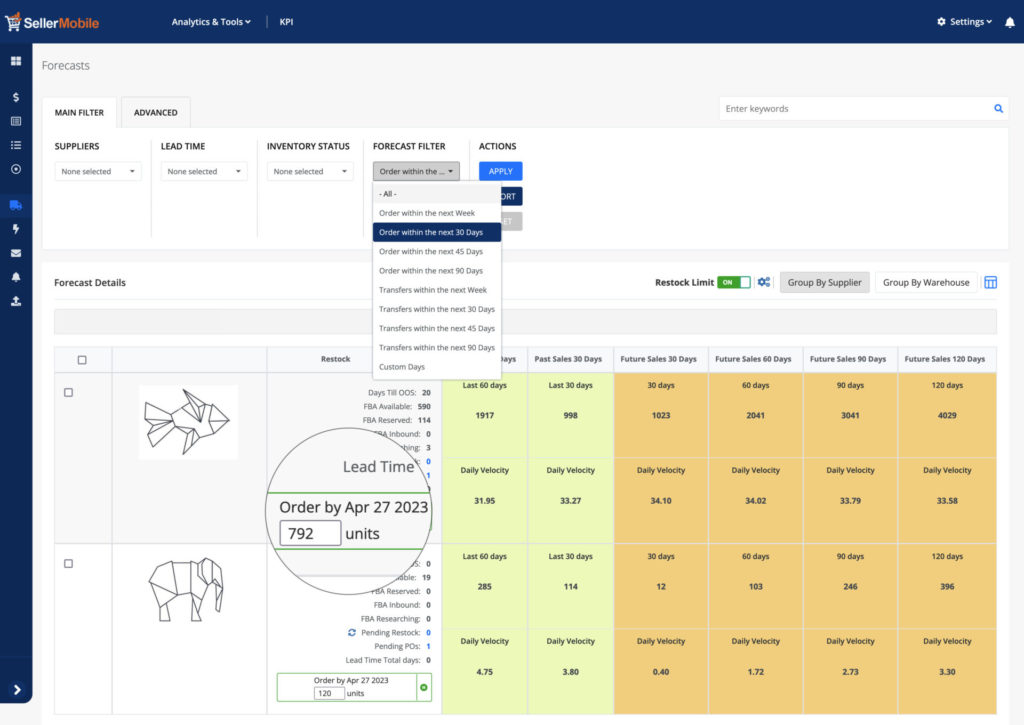

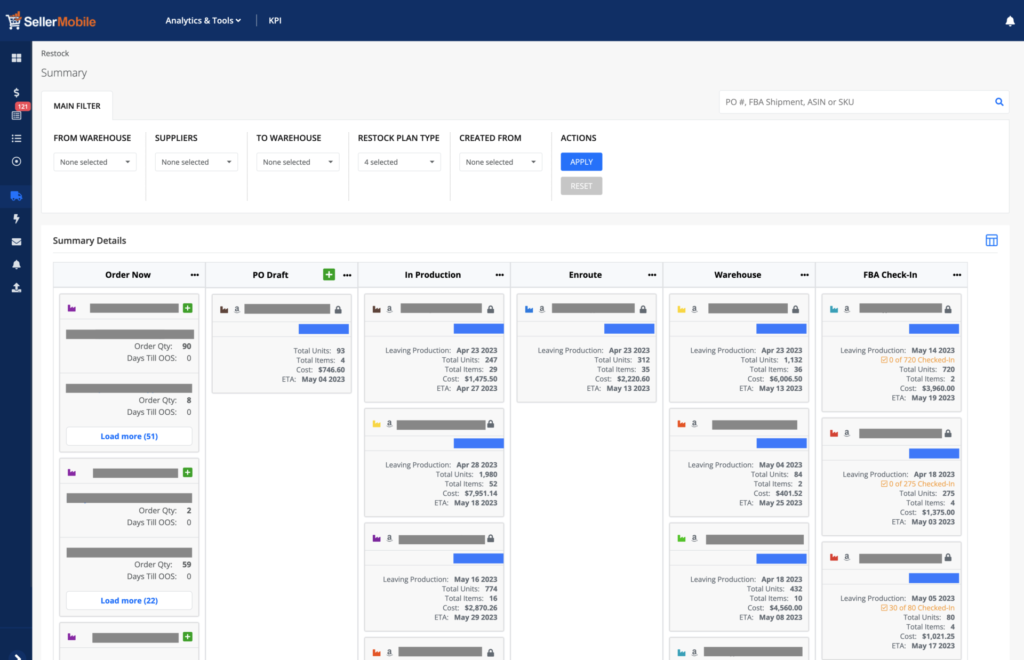

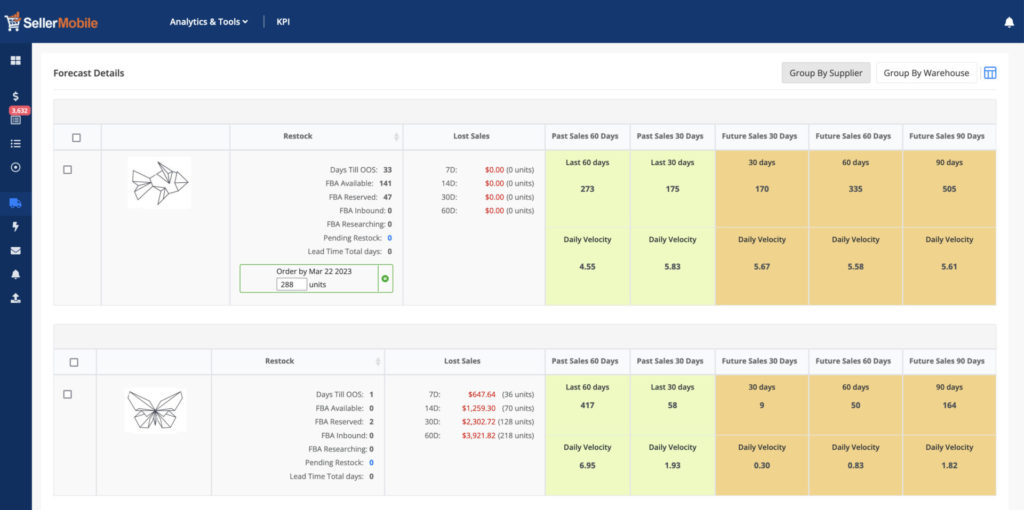

Always Ensure You Have Enough Stock | SellerMobile’s Restock Suggestions Will Help

Shedding further light on SellerMobile’s restock feature, it’s your go-to tool to avoid overstocking or understocking – two bad scenarios that cost you more Amazon seller fees while decreasing your profits.

SellerMobile keeps the golden balance between having enough stock and not stocking too much. It overrides forecasts based on cash flow and marketing plans, considering the marketplace trends and seasonality.

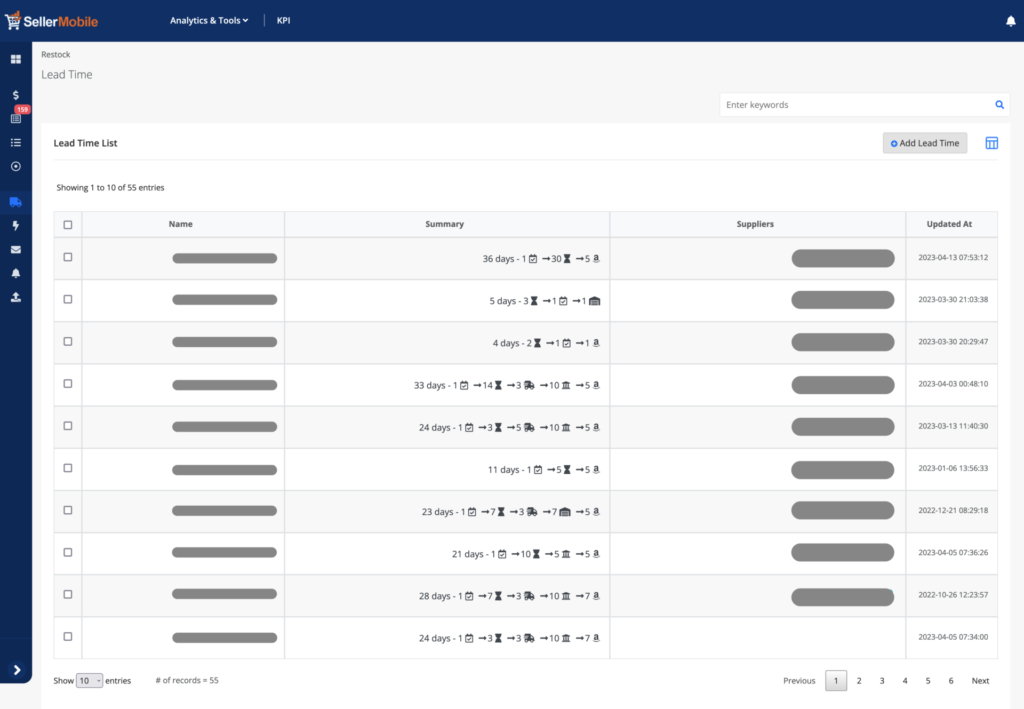

To increase the process’s accuracy, SellerMobile also allows you to update supplier lead times for different vendors manually. With this additional detail, SellerMobile’s restock suggestions are more refined and always in sync with your budget. The tool suggests you restock items considering how much time it can take before the next batch of products arrives from your particular vendor.

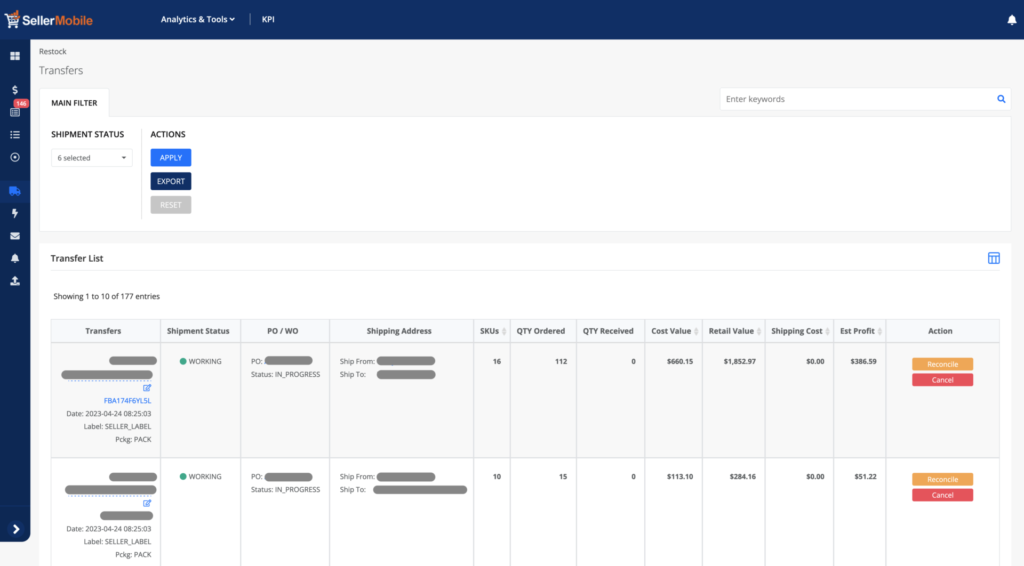

And when you have all your restock suggestions, SellerMobile allows you to add items to your FBA plan. You create transfer orders to Amazon from your 3PL or your warehouse, and the tool takes care of all the paperwork while you can be sure that your stock is always fresh.

With these features in place, you don’t decide on your stock levels by guesswork. You order as much stock as you need, ensuring your sales performance and profits remain high.

Monitor Amazon Policy Changes

And the last piece of advice – always stay on top of Amazon’s policy changes. There can be certain restrictions or rules that you need to abide by to keep your business on the right track. There can also be policies that benefit you and help you make even more money, which you may overlook and miss.

In most cases, you will be notified of relevant changes by Amazon’s Seller Central account. Whenever there is an important update, Amazon will automatically adjust the applicable settings in your account, and you can see changed Amazon marketplace seller fees in your transaction data.

Meanwhile, it’s crucial to closely monitor Amazon’s official resources, newsletters, and other channels to stay in the loop with all the policy updates.

6 Expert Tips to Manage Amazon Seller Fees

Well, now you know the main areas of Amazon marketplace seller fees and how to reduce them. But the whole story doesn’t end here. To help you with additional tips, we’ve compiled a quick overview of seller best practices that can help you deal with all your Amazon seller fees effectively.

This means ensuring smooth communication with Amazon and adhering to the best practices of Amazon selling. Let’s dive in!

1. Know Your Costs in Advance

One of the common mistakes that sellers make is not considering all the costs associated with their business in advance. This can result from a lack of reliable information sources or overlooking Amazon seller fees that can arise unexpectedly – but if you set your product pricing with no knowledge of the costs you will have to pay when selling on Amazon, you will likely be hit by a nasty surprise later.

What’s the simple formula here? Make sure you know all your costs in advance and build them into the price you charge for each product.

- Explore the above Amazon seller fee data in great detail. Which applies to you? How much will you pay for each fee, and when? Knowing this information lets you understand which margin you should add to each product and when you should expect revenue for your sales.

- Set your pricing accordingly to have your desired profit margin after all the Amazon seller fees are deducted from your payout.

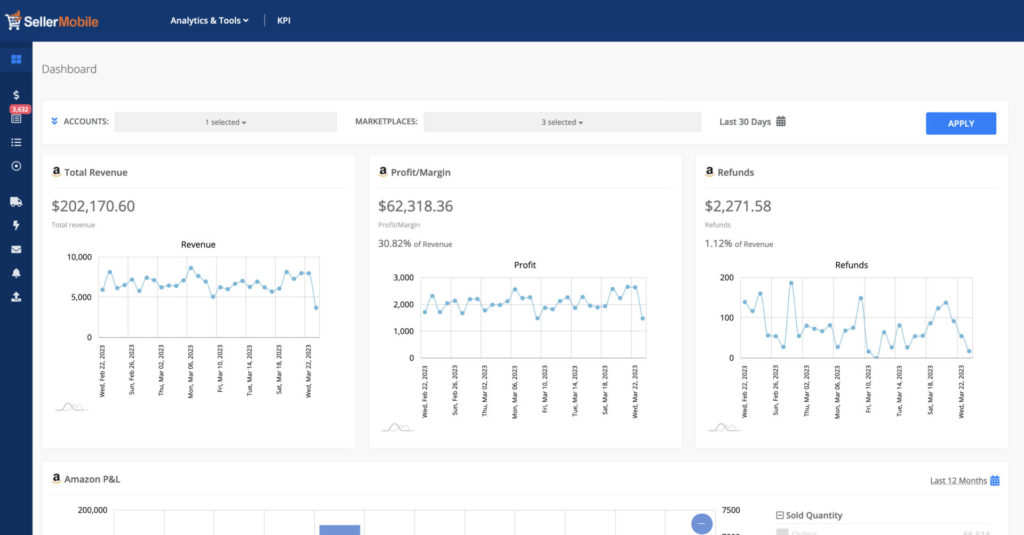

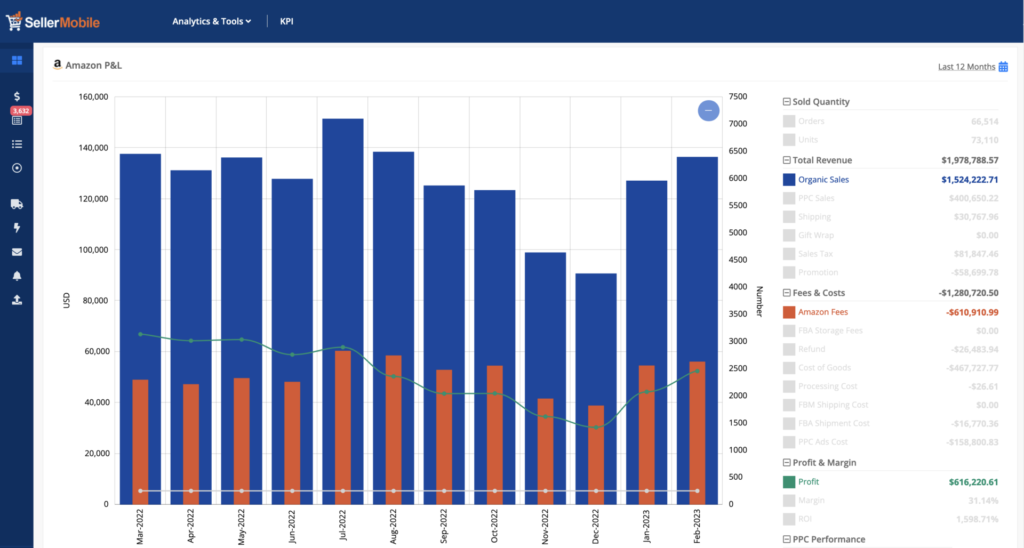

How Can SellerMobile Help?

SellerMobile’s profit dashboard allows you to see all your seller fees on Amazon and costs in a consolidated view. You can see all your expenses for each product in a particular timeframe and adjust prices accordingly.

The best thing is that you’ll not rely on manual research and calculations. SellerMobile’s fee calculator automatically considers all your costs and helps set your product prices in sync with your budget.

2. Optimize Product Pricing

Optimized product pricing goes beyond ensuring you have profit after paying all your Amazon seller fees. That’s the first and the most crucial thing to consider, but if you can earn more considering the market places and the demand for your products, why not use it?

Let’s say you have an item costing $30 to produce with an estimated $4.5 fee for Amazon FBA. You set the product price to $40 so that you earn the desired profit margin after deducting the fees.

But what if, after some research, you find out that the same item can be sold for $50 or even higher, depending on the demand and pricing trends? Why not earn more for the same product by optimizing its price?

With a deeper monitoring of the prices on Amazon’s marketplaces and a strategic approach to setting your prices, it would be possible for you to get more revenues from the same sales. Consequently, managing Amazon seller fees will become less of a challenge as you will have more room to cover them.

How Can SellerMobile Help?

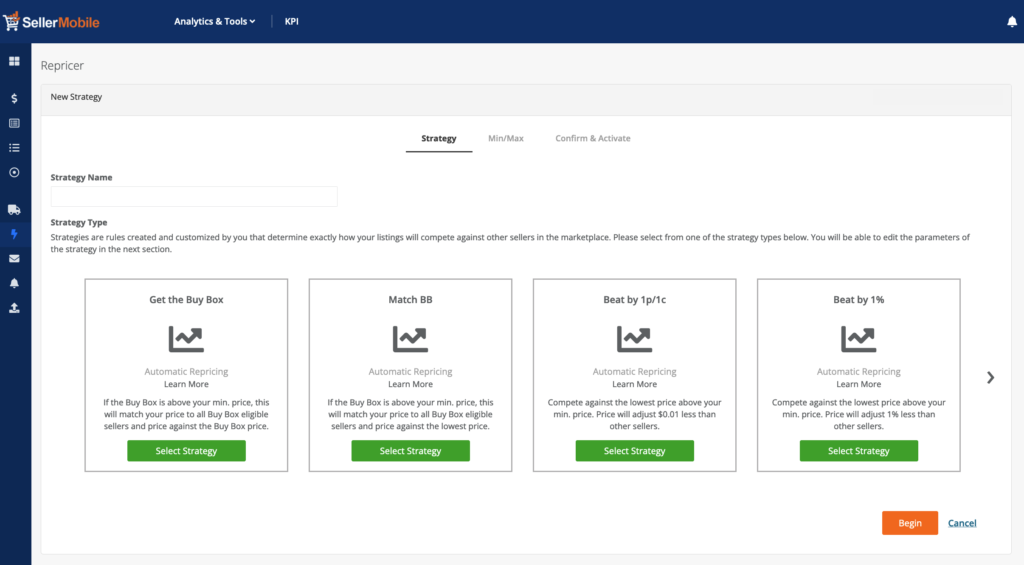

SellerMobile’s automated repricing tool lets you relax and let the software handle all your pricing needs. It does the heavy lifting by tracking the competitors’ prices and adjusting you accordingly.

Seems too good to be true? Let’s explore the process behind it.

SellerMobile knows all the key factors that can increase your chances of getting a higher price. It also knows which factors make you decrease your prices so you don’t lose sales because of unreasonably high pricing.

The tool relies on the following factors to make pricing suggestions.

- Competitor prices

- Recorded product price over time

- Inventory count (do you need to get rid of some items and set lower prices to sell them faster?)

- Time of the day (is there a specific time when the product performs better?)

- Sales velocity (how quickly is the product selling?)

As SellerMobile’s automated repricer adjusts the prices for you based on the above factors proven to have a real impact on sales, you can be sure that your product prices are in line with the market and set to deliver maximum revenues.

3. Minimize Referral Fees

There is no way to ask Amazon to charge less than it sets for referral fees for each product. However, you can see which items have lower referral fees and focus on selling more of them.

That’s especially useful for beginner Amazon sellers who don’t have an occupied niche that limits them to selling only one type of product. Unless you have a special passion for selling certain items, you can afford to focus on the ones with lower referral fees.

Here’s a table of the referral fees for different product categories. At a glance, you can see which items have lower seller fees on Amazon than others and which can become your top priority.

Don’t find something that makes you captivated?

What about joining FBA Small and Light – a program offering lower referral fees for some items based on size and weight?

Let’s introduce you to the program.

What Is FBA Small and Light Program?

Amazon’s Small and Light program is the special FBA program with lower referral fees for items with weight and dimensions below certain thresholds.

If the items you plan to sell on Amazon correspond to the following criteria, you can register them to get lower referral fees for each item sold.

- The item weights 3 lbs or less

- It measures 18 x 14 x 8 inches or smaller

- The product is priced at $12 or less

- It’s in a new condition and not restricted by Amazon

- The item was sold at least 25 times in the month before the registration

If you can put checkmarks on all of these items, you correspond to Amazon’s support program, which will help you earn more by deducting fewer fees from your revenues.

Among other benefits, these light and small items also have free shipping to Prime customers, which means you’ll not have to pay extra for shipping to the exclusive audience of Amazon Prime members.

Additionally, Amazon makes your customers trust you more by adding A-to-Z Guarantee for them, which covers timely delivery and proper product conditions. With these protection measures, customers will choose your product over competitors.

4. Optimize Fulfillment Methods

As you know from the previous paragraphs, you can choose different fulfillment options when selling on Amazon.

Amazon FBA (Fulfillment by Amazon) is the most popular option, as many who want to sell on Amazon are not e-commerce experts. They know what they want to sell but don’t specialize in logistics, warehousing, and other aspects of selling online. So, it’s far more rational to outsource these services to Amazon.

There also comes the FBM (Fulfillment by Merchant) for those with an existing warehouse and logistics system. Why should they pay Amazon for warehousing and shipping if they can do it themselves?

At first sight, FBA costs more than FBM because of all the added costs for additional services that Amazon is offering. However, don’t take it as an absolute truth.

There may be cases when FBA is a more cost-effective solution than FBM.

- If you sell oversize or heavy items, FBA may become too expensive, while FBM can help you reduce these costs. FBA is more friendly for small or middle-sized items, while its seller fees on Amazon for large items sharply increase.

- If you’re at the stage where your items need promotion on Amazon, FBA will handle Amazon SEO, winning the Buy Box and other promotion tasks for you, while FBM does not include such services. If you know you will need those, consider the costs of additional services you’ll need to hire and compare the whole price with FBA.

So, weighing all the pros and cons of each option is crucial and deciding which one will take your business to the next level.

5. Utilize Advanced Monitoring Tools

For those not deeply into Amazon’s financial data analysis, many fees and the scheme behind them still need to be solved. In the long run, the lack of proper monitoring may cost you a lot of money, as you’ll never know which costs exactly cut into your profit margins.

If you can relate, it’s time to make a change and start using advanced financial monitoring tools like SellerMobile, which tracks and analyzes for you.

The tool monitors your fees, sales figures, profits, and trends across your products and other elements of your e-commerce business. What do you win here? You see all the costs related to Amazon and their influence on your revenue. Consequently, you can identify and eliminate unnecessary seller fees on Amazon or reduce them.

To have all these benefits, just link your Amazon Seller Central account to SellerMobile and regularly track your profit data to see the detailed breakdown of your costs.

Professional monitoring tools will help you optimize your Amazon selling business and earn more money.

6. Utilize Sales Reports

Wrapping up the list of must-have tools for successful Amazon selling, the importance of having access to sales reports can’t be overstated. If you want to optimize your costs and Amazon seller fees, you need to clearly understand what’s selling, where your customers are located, and how much they spend per item.

With this data, you can manipulate your pricing strategy, make changes to product descriptions and assess potential new markets.

The easy part? SellerMobile will automatically generate all the required reports with all the necessary data. You’ll be left with clear insights into your sales performance, customers’ behavior, and other elements of your Amazon business without spending hours on manual data-gathering.

Here are the key SellerMobile reports you can benefit from.

Final Words

Amazon seller fees are inevitable, but they don’t have to cripple your business. It’s just about how you manage them.

If you know which items to sell and at what price, leverage tools to optimize your listing, and use advanced monitoring tools to stay on top of your costs, you can make more profit and reduce your costs.

It can seem overwhelming and complex when you’re unfamiliar with Amazon seller fees scheme, but with the right tools and knowledge, it can become a piece of cake.

Your trusted friend in monitoring Amazon costs and profits is SellerMobile – the all-in-one Amazon financial assistant. You can be sure to keep your costs under control while optimizing the performance of your Amazon business.